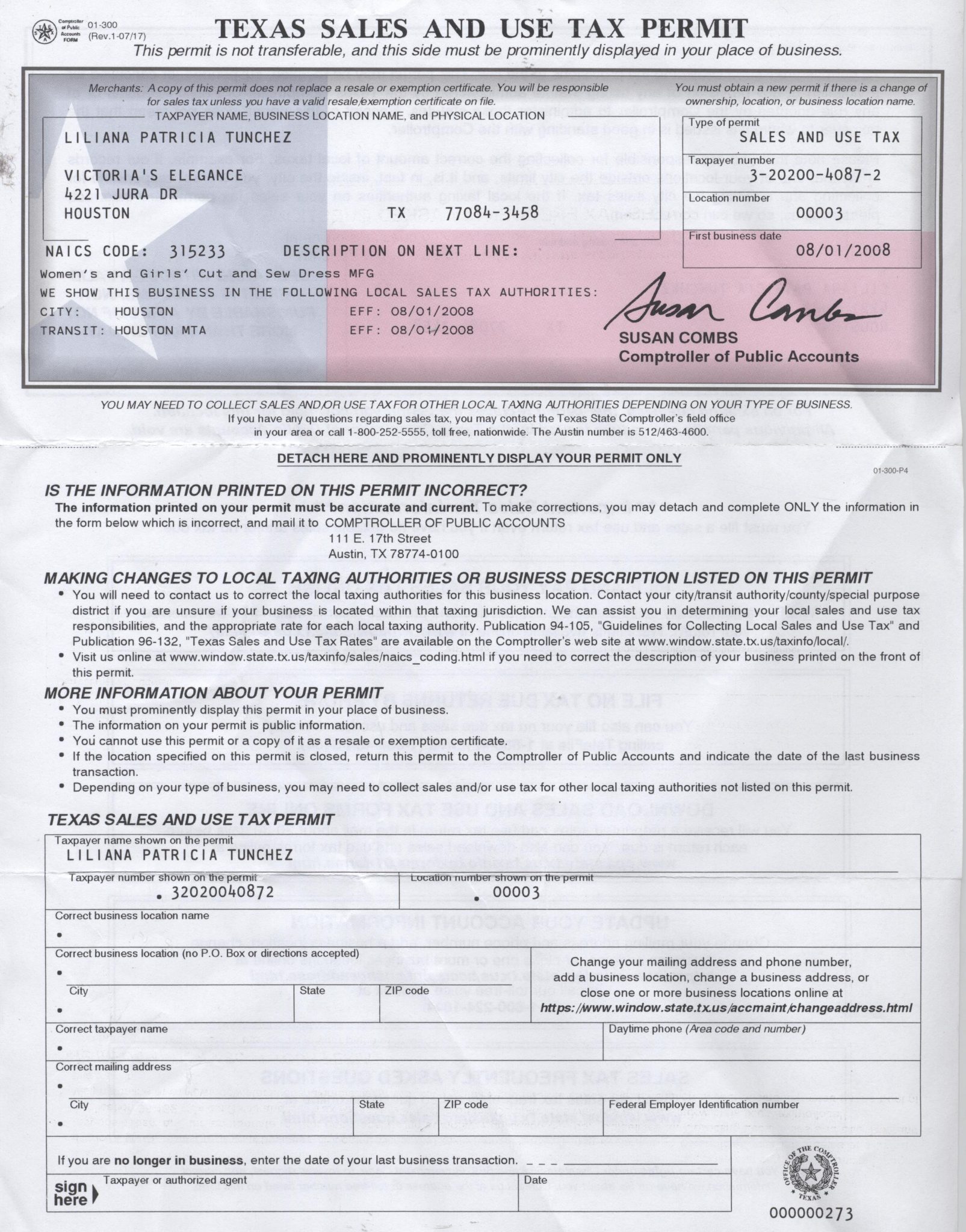

Webthe current motor vehicle tax rate is 6. 25 percent. The first texas motor vehicle sales and use tax rate, in 1941, was 1 percent. The texas legislature increased. Webmotor vehicle sales tax is due on each retail sale of a motor vehicle in texas. A motor vehicle sale includes installment and credit sales and exchanges for property, services. Webhow are vehicle sales taxed in texas? Texas sales tax on car purchases: Vehicles purchases are some of the largest sales commonly made in texas, which means that. Webyou can use our texas sales tax calculator to look up sales tax rates in texas by address / zip code. The calculator will show you the total sales tax amount, as well as the county,. Webdec 9, 2022 · if buying from an individual, a motor vehicle sales tax (6. 25 percent) on either the purchase price or standard presumptive value (whichever is the highest value), must.

Related Posts

Recent Post

- General Manager Of Walmart Salary

- Travel Trailer Review

- Waterfront Homes For Sale On Castle Rock Lake Wi

- Best Shotgun For Sporting Clays

- 84 Lumber Floor Plans

- Cb Radio Repair Shops Near My Location

- Fuel Hauler Owner Operator

- Wpmi News 15

- Menards In Pa

- Zillow York Pa

- Lint Spawns Grounded

- Tiny Home For Sale In Pa

- Kvta Crime News

- Shooting In Tupelo Ms Yesterday

- Apple Cinemas Hartford Ct Showtimes

Trending Keywords

Recent Search

- Whimsigoth Bedding

- Pharmacology Quizlet

- Gender Tf Story

- Straight Spy Twitter

- Shreveport Times Obituary Archives

- Survivor Wiki

- 31 Totes Bags

- Gun Show Lancaster Ohio

- Gopuff Delivery Driver Salary

- Parker Tornado Crossbow

- Sims Mortuary Inc

- Best City For Doordash

- Pantyhose Lot

- Can T Be Saved Nba Youngboy Lyrics

- Teenage Boy Long Hair